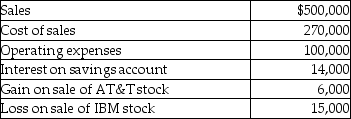

In the current year,ABC Corporation had the following items of income,expense,gains,and losses:  What is taxable income for the year?

What is taxable income for the year?

Definitions:

Contingency Management

A behavioral intervention program that modifies behavior by changing the consequences of behaviors through rewards or punishments.

Sociocultural Approach

An understanding that individuals' behavior and thinking are influenced by their social and cultural contexts.

Social Interactions

The process by which individuals act and react in relation to others, involving communication, behavior, and influence within social contexts.

Role Transitions

Changes in an individual's social positions or roles that require adjustment and adaptation, which can have significant psychological impacts.

Q20: Mae Li is beneficiary of a $70,000

Q30: Natasha is a single taxpayer with a

Q51: Martha,an accrual-method taxpayer,has an accounting practice.In 2015,she

Q54: Ben is a well-known professional football quarterback.His

Q71: Nondiscrimination requirements do not apply to working

Q87: Alimony received is taxable to the recipient

Q89: Sheila sells stock,which has a basis of

Q101: Paul and Sally file a joint return

Q104: An individual is considered terminally ill for

Q111: Interest on the obligations of the U.S.government,states,territories,and