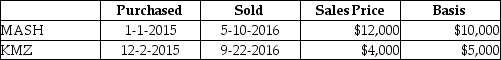

Nate sold two securities in 2016:  Nate has a 25% marginal tax rate.What is the additional tax resulting from the above sales?

Nate has a 25% marginal tax rate.What is the additional tax resulting from the above sales?

Definitions:

Job-Order Costing

An accounting method used to track costs and evaluate the profitability of individual jobs or batches, particularly useful in custom or unique production environments.

Direct Costs

Expenses that can be directly traced to the production of specific goods or services.

Predetermined Overhead Rate

An estimated rate used to allocate manufacturing overhead costs to products or job orders, based on a chosen activity base.

Machine-Hours

A unit of measure representing the operational use time of a machine, commonly used in allocating manufacturing overhead costs in product costing.

Q16: "No additional cost" benefits are excluded from

Q23: Tony supports the following individuals during the

Q39: Gwen's marginal tax bracket is 25%.Gwen pays

Q46: Benefits covered by Section 132 which may

Q69: A taxpayer may avoid tax on income

Q100: Before consideration of stock sales,Rex has generated

Q108: Discuss tax planning considerations which a taxpayer

Q110: Losses incurred in the sale or exchange

Q122: Kate subdivides land held as an investment

Q122: Wes owned a business which was destroyed