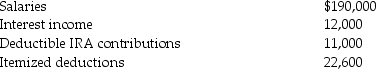

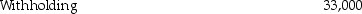

The following information is available for Bob and Brenda Horton,a married couple filing a joint return,for 2016.Both Bob and Brenda are age 32 and have no dependents.

a.What is the amount of their gross income?

a.What is the amount of their gross income?

b.What is the amount of their adjusted gross income?

c.What is the amount of their taxable income?

d.What is the amount of their tax liability (gross tax)?

e.What is the amount of their tax due or (refund due)?

Definitions:

Debt Refunding

The process of replacing an existing debt obligation with a new one, often with more favorable terms.

Ordinary Income

Earnings derived from standard business operations and not classified as capital gains or dividend income.

Extraordinary Income

Uncommon and infrequent gains not related to the normal operations of a business.

Effective Interest Amortization

A method for calculating the amortized cost of a bond or loan based on periodic interest expense, reflecting the actual interest rate.

Q4: A taxpayer is able to change his

Q11: Hazel Corporation reported the following results for

Q15: Mark receives a nonliquidating distribution of $10,000

Q48: Taxpayers often have to decide between contributing

Q77: Adanya's marginal tax rate is 39.6% and

Q77: The C Corporation Model is a variation

Q79: Donald sells stock with an adjusted basis

Q88: Rick chose the following fringe benefits under

Q113: Distributions from corporations to the shareholders in

Q124: Johnson Corporation has $300,000 of AMTI before