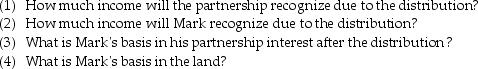

Mark receives a nonliquidating distribution of $10,000 cash and a parcel of land having an adjusted basis of $18,000 and a fair market value of $25,000.

a.Mark's basis in his partnership interest prior to the distribution is $50,000.

b.Assume Mark's basis in his partnership interest is instead $22,000 and redetermine the responses to questions (1)through (4).

b.Assume Mark's basis in his partnership interest is instead $22,000 and redetermine the responses to questions (1)through (4).

Definitions:

Positive Reinforcement

A process that strengthens a behavior by presenting a rewarding stimulus after the behavior occurs.

360-Degree Feedback

A feedback process where employees receive confidential, anonymous feedback from the people who work around them, including peers, subordinates, and supervisors.

Democratic Management Style

A management approach characterized by involving employees in decision-making processes, thus promoting workplace democracy.

Experiencing Flow

A mental state of complete immersion and involvement in an activity, where time seems to pass unnoticed, and the individual experiences enjoyment and intrinsic motivation.

Q2: Elaine owns equipment ($23,000 basis and $15,000

Q28: Speak Corporation,a calendar year accrual-basis taxpayer,sell packages

Q29: Generally,when a married couple files a joint

Q29: In the Current Model,investment earnings are taxed

Q33: David,age 62,retires and receives $1,000 per month

Q36: The person claiming a dependency exemption under

Q53: S status can be elected if 50%

Q102: What is the primary purpose of Form

Q142: Bill and Tessa have two children whom

Q148: John supports Kevin,his cousin,who lived with him