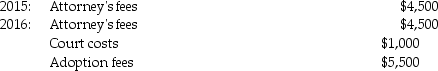

Tyler and Molly,who are married filing jointly with $210,000 of AGI in 2016,incurred the following expenses in their efforts to adopt a child:

The adoption was finalized in 2016 What is the amount of the allowable adoption credit in 2016?

The adoption was finalized in 2016 What is the amount of the allowable adoption credit in 2016?

Definitions:

Evolution

The developmental process in which varied organisms are assumed to have originated and expanded from initial forms throughout Earth's chronological past.

Beak Size

A morphological trait in birds and some other animals, influencing their feeding habits and ecological niche, often subject to evolutionary adaptation.

Hindlimbs

The rear limbs of an animal, especially those on the vertebrates, used for locomotion or support.

High Altitude

Pertains to areas that are significantly elevated above sea level, affecting oxygen levels and often requiring physiological adaptation for survival.

Q25: Corkie Corporation distributes $80,000 cash along with

Q26: Imputation of interest could be required on

Q27: Discuss the tax consequences of a complete

Q52: Individuals Rhett and Scarlet form Lady Corporation.Rhett

Q63: A wage cap does not exist for

Q66: When preparing a tax return for a

Q72: Regulations issued prior to the latest tax

Q106: Burton and Kay are married,file a joint

Q109: Carlotta,Inc.has $50,000 foreign-source income and $150,000 worldwide

Q110: If a cash basis taxpayer gives a