-Suppose a perfectly competitive market is in long-run equilibrium and then there is a permanent increase in the demand for that product. The new long-run equilibrium will have

Definitions:

Forward Rate

The agreed-upon price for a financial transaction to be executed at a future date, used particularly in currency and interest rate markets.

2-year Bond

A debt security that matures in two years and typically offers periodic interest payments.

Stripped Treasuries

Securities derived from U.S. Treasury bonds by separating the coupons from the principal, allowing them to be sold separately as zero-coupon bonds.

Pure Yield Curve

A theoretical representation of the rates of interest for zero-coupon bonds across different maturities under the assumption of no risk.

Q2: One way to overcome the tragedy of

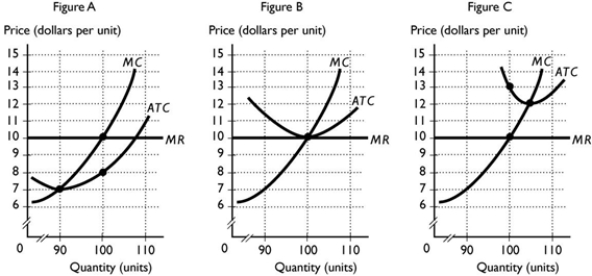

Q22: The figure above shows Firm X. The

Q31: The free-rider problem exists because<br>A) some goods

Q36: A good is rival if<br>A) it has

Q36: The table above gives Ali's total utility

Q39: Timmy makes $100 per week working in

Q40: Average total cost equals<br>A) average fixed cost

Q45: A perfectly competitive firm's short-run supply curve

Q49: A good or resource that is both

Q86: The table above has the domestic demand