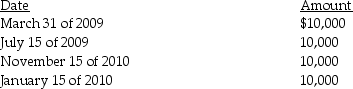

Jack has a basis of $36,000 in his 1,000 shares of Acorn Corporation stock (a capital asset). The stock was acquired three years ago. He receives the following distributions as part of a plan of liquidation of Acorn Corporation:

What are the amount and character of the gain or loss that Jack will recognize during 2009? During 2010?

What are the amount and character of the gain or loss that Jack will recognize during 2009? During 2010?

Definitions:

Disinflation

A reduction in inflation rates, signaling a deceleration in the pace at which the prices of goods and services rise.

CPI

The Consumer Price Index serves as a measurement tool that quantifies the average cost of a selected range of consumer goods and services, taking into account food, transportation, and healthcare, through weighted average prices.

Disinflation

A decrease in the rate of inflation, resulting in a slow down in the rate at which prices are rising.

Deflation

is the decrease in the general price level of goods and services, often signifying an economic contraction.

Q13: Proper maintenance of test security by counselors

Q24: Identify which of the following statements is

Q30: Lynn transfers land having a $50,000 adjusted

Q32: Chip and Dale are each 50% owners

Q47: Yee manages Huang real estate, a partnership

Q50: Identify which of the following statements is

Q52: George pays $10,000 for a 20% interest

Q62: What is included in partnership taxable income?

Q66: Jeffrey Corporation has asked you to prepare

Q90: Mullins Corporation is classified as a PHC