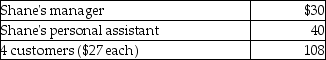

Shane,an employee,makes the following gifts,none of which are reimbursed:  What amount of the gifts is deductible before application of the 2% of AGI floor for miscellaneous itemized deductions?

What amount of the gifts is deductible before application of the 2% of AGI floor for miscellaneous itemized deductions?

Definitions:

Voting Shares

Equity securities that grant the holder the right to vote on company matters, such as board elections and major corporate decisions.

Net Income

The net income of a business once all costs and taxes are subtracted from its total revenues.

Fair Value Through Other Comprehensive Income

A financial accounting method where certain assets are revalued periodically and changes are recorded in other comprehensive income.

Balance Sheet

A financial statement that reports a company's assets, liabilities, and shareholders' equity at a specific point in time.

Q7: A taxpayer incurs a net operating loss

Q10: Low-income families who struggle to obtain enough

Q13: Inadequate intake of iodine during pregnancy may

Q17: Older adults who participate in strength training

Q23: One reason that obesity is increasing in

Q32: The nutrient that provides the major energy

Q61: Jorge owns activity X which produced a

Q76: If the standard mileage rate is used

Q87: For purposes of the application of the

Q129: Juanita knits blankets as a hobby and