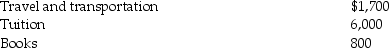

Ellie,a CPA,incurred the following deductible education expenses to maintain or improve her skills:  Ellie's AGI for the year is $60,000.

Ellie's AGI for the year is $60,000.

a.If Ellie is self-employed,what are the amount of and the nature of the deduction for these expenses?

b.If,instead,Ellie is an employee who is not reimbursed by his employer,what are the amount of and the nature of the deduction for these expenses (after limitations)?

Definitions:

Q3: Leo spent $6,600 to construct an entrance

Q11: Determine the net deductible casualty loss on

Q18: An example of a clinical observation associated

Q38: Doses of iron supplements recommended for women

Q40: The first step in the Nutrition Care

Q40: Sacha purchased land in 2010 for $35,000

Q71: Brandon,a single taxpayer,had a loss of $48,000

Q90: Generally,50% of the cost of business gifts

Q99: Under a qualified pension plan,the employer's deduction

Q99: Emeril borrows $340,000 to finance taxable and