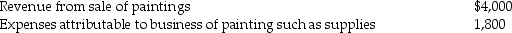

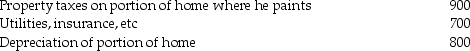

Dighi,an artist,uses a room in his home (250 square feet)as a studio exclusively to paint.The studio meets the requirements for a home office deduction.(Painting is considered his trade or business.)The following information appears in Dighi's records:  Expenses related to home office:

Expenses related to home office:  (a)What is the amount of Dighi's home office deduction if he is self-employed?

(a)What is the amount of Dighi's home office deduction if he is self-employed?

(b)If some amount is not allowed under the tax law,how is the disallowed amount treated?

(c)Assume all of Dighi's records of expenses relating to the room were destroyed in a major paint spill.How much of a home office deduction,if any,will he be allowed?

Definitions:

Polygraph Test

A lie detector test that measures and records several physiological indices such as blood pressure, pulse, respiration, and skin conductivity while the subject answers a series of questions.

Without Recourse

A clause indicating that the holder of a negotiable instrument cannot seek payment from the sender in the event of non-payment by the intended party.

Contractual Liability

Legal obligations arising from contracts entered into by an entity or individual.

Warranty Liability

The legal obligation of a seller to ensure the goods or services sold meet certain quality and performance standards.

Q3: Leo spent $6,600 to construct an entrance

Q10: The mineral that helps control enzyme actions

Q22: Foods and beverages ingested immediately after an

Q32: Christopher,a cash basis taxpayer,borrows $1,000 from ABC

Q36: Nutrition therapy is likely to be successful

Q61: Jordan,an employee,drove his auto 20,000 miles this

Q65: Chuck,who is self-employed,is scheduled to fly from

Q81: Partnerships and S corporations must identify their

Q97: Jamahl and Indira are married and live

Q145: Fin is a self-employed tutor,regularly meeting with