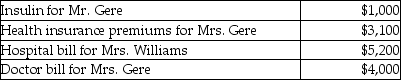

Mr.and Mrs.Gere,who are filing a joint return,have adjusted gross income of $50,000.During the tax year,they paid the following medical expenses for themselves and for Mrs.Gere's mother,Mrs.Williams.The Gere's could claim Mrs.Williams as their dependent,but she has too much gross income.  Mr.and Mrs.Gere received no reimbursement for the above expenditures.What is the amount of their deductible itemized medical expenses?

Mr.and Mrs.Gere received no reimbursement for the above expenditures.What is the amount of their deductible itemized medical expenses?

Definitions:

Intensity

The magnitude or strength of a phenomenon, often used in context with physical phenomena such as light, sound, and emotions.

Amplitude

The magnitude or intensity of a wave's fluctuation, measured from its baseline to its peak, in physical and electrical phenomena.

Relative Motion

The concept that the motion of an object is always determined relative to some other moving or stationary object.

Frequency

The rate at which something occurs over a particular period of time or in a given sample.

Q4: Exchange Lists for Meal Planning groups foods

Q17: Hobby expenses are deductible as for AGI

Q20: During the year,Cathy received the following: •

Q24: Nutritional treatment of pregnancy-induced hypertension should focus

Q43: A major reason that dehydration can develop

Q51: Melanie,a single taxpayer,has AGI of $220,000 which

Q58: Ola owns a cottage at the beach.She

Q69: Points paid in connection with the purchase

Q95: Pat is a sales representative for a

Q99: The discharge of certain student loans is