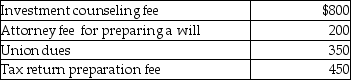

Daniel had adjusted gross income of $60,000,which consisted of $55,000 in wages and $5,000 in dividend income from taxable domestic corporations.His expenses include:  What is the net amount deductible by Daniel for the above items?

What is the net amount deductible by Daniel for the above items?

Definitions:

Strategic Contingencies

Critical events or factors that significantly influence the success of strategies or decision-making processes within organizations.

Source Of Uncertainty

Any factor or condition that creates doubt or ambiguity in decision-making or planning.

Defensive Behaviour

Actions or reactions aimed at protecting oneself from perceived threats, criticism, or blame, often at the expense of productive communication.

Overconforming

Exceeding the norms or standards in a given context, often to garner approval or prevent criticism.

Q14: A review of the 2015 tax file

Q24: Chloe receives a student loan from a

Q37: A taxpayer has low AGI this year,but

Q46: A taxpayer reports capital gains and losses

Q53: Juanita,who is single,is in an automobile accident

Q67: The definition of medical care includes preventative

Q83: Amounts withdrawn from Qualified Tuition Plans are

Q85: Lena owns a restaurant which was damaged

Q89: SIMPLE retirement plans allow a higher level

Q96: All of the following may deduct education