MrAnd MrsThibodeaux,who Are Filing a Joint Return,have Adjusted Gross Income of of $75,000.During

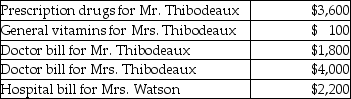

Mr.and Mrs.Thibodeaux,who are filing a joint return,have adjusted gross income of $75,000.During the tax year,they paid the following medical expenses for themselves and for Mrs.Thibodeaux's mother,Mrs.Watson (age 63) .Mrs.Watson provided over one-half of her own support.  Mr.and Mrs.Thibodeaux received no reimbursement for the above expenditures.What is the amount of their deductible itemized medical expenses?

Mr.and Mrs.Thibodeaux received no reimbursement for the above expenditures.What is the amount of their deductible itemized medical expenses?

Definitions:

Recursive Functions

Functions that call themselves within their own definition, often used for tasks that can be broken into similar subtasks.

Iterative Solution

A method of solving a problem by repeatedly applying a set of operations until a certain condition is met, typically used in loops and iterations.

Declaration Statement

A statement in programming that declares a new variable or function, specifying its type and, optionally, initializing it.

Function Body

The section of a function in a program that contains the actual statements that execute when the function is called.

Q12: Ron obtained a new job and moved

Q13: The medical term for a reduced amount

Q23: Exter Company is experiencing financial difficulties.It has

Q26: Hugh contributes a painting to a local

Q32: The factor that is likely to contribute

Q61: Jorge owns activity X which produced a

Q91: Generally,gains resulting from the sale of collectibles

Q113: If the principal reason for a taxpayer's

Q127: How long must a capital asset be

Q133: Chen had the following capital asset transactions