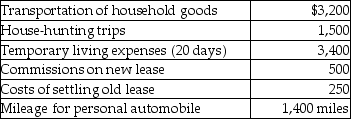

Ron obtained a new job and moved from Houston to Washington.He incurred the following moving expenses:  Assuming Ron is eligible to deduct his moving expenses,what is the amount of the deduction?

Assuming Ron is eligible to deduct his moving expenses,what is the amount of the deduction?

Definitions:

Marketing Mix

An assortment of controllable variables by a company aimed at encouraging customers to buy its offerings, namely product, price, place, and promotion.

Vending Machine

A machine operating automatically that dispenses products like snacks, drinks, and various items to customers once they input money, use a credit card, or insert a purpose-made card.

Marketing Mix

A blend of elements under a company's control designed to motivate purchases by consumers, often referred to as the product, price, location, and advertising.

Commercial

An advertisement broadcast on television or radio, designed to promote and sell a product or service to the public.

Q3: The percentage of the total daily caloric

Q43: Interest expense on debt incurred to purchase

Q62: A passive activity includes any rental activity

Q87: Expenditures for a weight reduction program are

Q89: Riva borrows $10,000 that she intends to

Q89: A flood damaged an auto owned by

Q92: An expense is considered necessary if it

Q94: Rita,a single employee with AGI of $100,000

Q111: Joe is a self-employed tax attorney who

Q132: Discuss tax planning considerations which a taxpayer