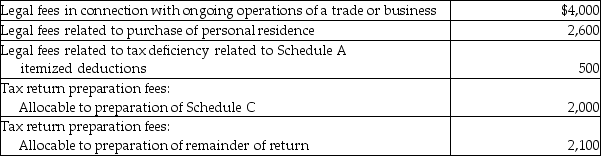

Maria pays the following legal and accounting fees during the year:  What is the total amount of her for AGI deduction for these fees?

What is the total amount of her for AGI deduction for these fees?

Definitions:

Balance Sheet

An accounting statement that itemizes the total assets, liabilities, and equity of shareholders at a defined date.

Accounts Payable

Liabilities owed by a business to its suppliers or vendors for goods and services purchased on credit.

Net Income

The earnings a company retains following the deduction of all costs and taxes from its revenue.

Rent Expense

The cost incurred by a business to use property or equipment for business purposes.

Q4: All of the following payments for medical

Q4: Exchange Lists for Meal Planning groups foods

Q5: Tyne is a 48-year-old an unmarried taxpayer

Q38: Jeffrey,a T.V.news anchor,is concerned about the wrinkles

Q72: Joseph has AGI of $170,000 before considering

Q73: A taxpayer owns 200 shares of stock

Q78: Abby owns a condominium in the Great

Q88: Kathleen received land as a gift from

Q105: This summer,Rick's home (which has a basis

Q127: Thomas purchased an annuity for $20,000 that