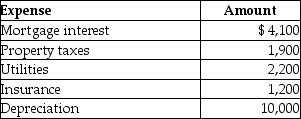

Abby owns a condominium in the Great Smokey Mountains.During the year,Abby uses the condo a total of 21 days.The condo is also rented to tourists for a total of 79 days and generates rental income of $12,500.Abby incurs the following expenses:  Using the IRS method of allocating expenses,the amount of depreciation that Abby may take with respect to the rental property will be

Using the IRS method of allocating expenses,the amount of depreciation that Abby may take with respect to the rental property will be

Definitions:

Hamilton

Hamilton is most commonly associated with Alexander Hamilton, one of the Founding Fathers of the United States, known for his role in drafting the Constitution and as the first Secretary of the Treasury.

IRS

The Internal Revenue Service, a U.S. government agency responsible for tax collection and tax law enforcement.

Business Days

Refers to the standard days in a week (excluding weekends and public holidays) considered as working days for conducting business.

Deposit

A sum of money placed in an account or given as security for a financial transaction or agreement.

Q8: All of the following losses are deductible

Q9: All casualty loss deductions,regardless of the type

Q27: During 2014,Christiana's employer withheld $1,500 from her

Q38: Cameron is the owner and beneficiary of

Q53: The standard deduction is the maximum amount

Q70: Dighi,an artist,uses a room in his home

Q86: On December 1,Robert,a cash method taxpayer,borrows $10,000

Q90: Jana reports the following income and loss:

Q91: In the current year,Marcus reports the following

Q122: Charitable contributions made to individuals are deductible