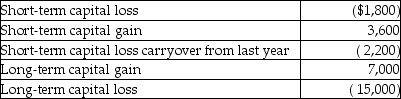

During the current year,Nancy had the following transactions:  What is the amount of her capital loss deduction for the current year,and what is the amount and character of her capital loss carryover?

What is the amount of her capital loss deduction for the current year,and what is the amount and character of her capital loss carryover?

Definitions:

Foreclosure

A legal process in which a lender attempts to recover the balance of a loan from a borrower who has stopped making payments.

Suicidal Tendencies

A range of thoughts or behaviors indicating an individual's consideration or risks of attempting suicide.

Drug Abuse

The harmful or hazardous use of psychoactive substances, including alcohol and illicit drugs, leading to addiction or other detrimental health effects.

Authoritative Homes

Environments where parenting is responsive and demanding, fostering independence while maintaining limits and structure.

Q7: Assume Congress wishes to encourage healthy eating

Q25: Foreign real property taxes and foreign income

Q34: All of the following statements regarding self-employment

Q37: Capital expenditures add to the value,substantially prolong

Q51: An accrual-basis taxpayer may elect to accrue

Q59: In 2015 Sela traveled from her home

Q61: All of the following fringe benefits paid

Q79: A building used in a business is

Q83: A taxpayer sells an asset with a

Q124: A key factor in determining tax treatment