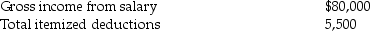

Steve Greene,age 66,is divorced with no dependents.In 2015 Steve had income and expenses as follows:  Compute Steve's taxable income for 2015.Show all calculations.

Compute Steve's taxable income for 2015.Show all calculations.

Definitions:

Constructive Alternativism

The idea that we are free to revise or replace our constructs with alternatives as needed.

Freedom

The power or right to act, speak, or think as one wants without hindrance or restraint; often considered a fundamental human right.

Two-Factor Theory

A psychology theory proposing that emotions are based on physiological arousal and cognitive labeling of that arousal.

Self-Actualized Individuals

Persons who have achieved their fullest potential, realizing personal talent, self-fulfillment, and peak experiences, as described by Maslow.

Q1: Gwen's marginal tax bracket is 25%.Gwen pays

Q6: Qualified tuition and related expenses eligible for

Q17: On July 25,2014,Marilyn gives stock with a

Q21: If there is a like-kind exchange of

Q46: Glen owns a building that is used

Q53: The standard deduction is the maximum amount

Q63: Rick chose the following fringe benefits under

Q67: Child support is<br>A)deductible by both the payor

Q84: Niral is single and provides you with

Q103: For livestock to be considered Section 1231