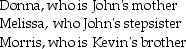

John supports Kevin,his cousin,who lived with him throughout 2015.John also supports three other individuals who do not live with him:  Assume that Donna,Melissa,Morris and Kevin each earn less than $4,000.How many personal and dependency exemptions may John claim?

Assume that Donna,Melissa,Morris and Kevin each earn less than $4,000.How many personal and dependency exemptions may John claim?

Definitions:

Unsecured Loan

A loan that doesn't require any collateral and is based primarily on the borrower's creditworthiness and ability to repay.

Beginning Inventory

The price of merchandise available for purchase at the commencement of a fiscal period.

Freight-in

The cost of shipping goods into a business, which is often included in the cost of inventory.

Cost of Goods

Cost of Goods refers to the direct costs attributable to the production of the goods sold by a company, including materials and labor.

Q4: Lana owned a house used as a

Q37: Blaine Greer lives alone.His support comes from

Q39: In the current year,Andrew received a gift

Q55: Under the cash method of accounting,income is

Q58: Ola owns a cottage at the beach.She

Q70: Section 1245 recapture applies to all the

Q108: Joel has four transactions involving the sale

Q117: If a capital asset held for one

Q121: A taxpayer acquired an office building to

Q140: Which of the following credits is considered