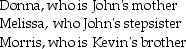

John supports Kevin,his cousin,who lived with him throughout 2015.John also supports three other individuals who do not live with him:  Assume that Donna,Melissa,Morris and Kevin each earn less than $4,000.How many personal and dependency exemptions may John claim?

Assume that Donna,Melissa,Morris and Kevin each earn less than $4,000.How many personal and dependency exemptions may John claim?

Definitions:

Never Events

Serious, preventable patient safety incidents that should never happen in healthcare settings, such as surgery on the wrong site.

Skilled Nursing

A high level of medical care that is provided by trained individuals, such as registered nurses, to patients with serious illnesses or conditions.

Extensive Wound Care

A comprehensive approach to treating serious wounds that involves cleaning, protecting, and potentially surgical intervention to promote healing.

Hospice

System of family-centered care designed to help terminally ill people be comfortable and maintain a satisfactory lifestyle throughout the terminal phase of their illness.

Q13: Rex has the following AMT adjustment factors:

Q17: Katie,a self-employed CPA,purchased an accident & disability

Q53: The taxable portion of a gain from

Q56: WAM Corporation sold a warehouse during the

Q76: During the current year,Danika recognizes a $30,000

Q107: Adam purchased 1,000 shares of Airco Inc.common

Q109: Which of the following item(s)must be included

Q114: C corporations and partnerships with a corporate

Q114: Gregory receives 100 shares of stock from

Q144: Cheryl is claimed as a dependent on