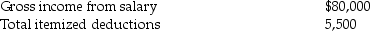

Steve Greene,age 66,is divorced with no dependents.In 2015 Steve had income and expenses as follows:  Compute Steve's taxable income for 2015.Show all calculations.

Compute Steve's taxable income for 2015.Show all calculations.

Definitions:

Inventory Turnover

A ratio showing how often a company's inventory is sold and replaced over a specific period, indicating the efficiency in managing inventory levels.

Times Interest Earned

A financial ratio that measures a company's ability to meet its interest payments from its earnings before interest and taxes.

Interest Expense

The cost incurred by an entity for borrowed funds, typically expressed as an annual rate.

Quick Assets

Liquid assets that can be rapidly converted into cash, excluding inventory, such as cash, marketable securities, and receivables.

Q9: The following gains and losses pertain to

Q27: Melody inherited 1,000 shares of Corporation Zappa

Q34: Rolf exchanges an office building worth $150,000

Q37: Jack exchanged land with an adjusted basis

Q61: Allison buys equipment and pays cash of

Q89: Donald has retired from his job as

Q91: Generally,gains resulting from the sale of collectibles

Q91: "Gross income" is a key term in

Q104: Under UNICAP,all of the following overhead costs

Q136: A taxpayer can receive innocent spouse relief