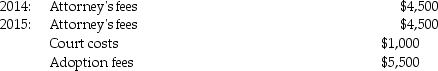

Tyler and Molly,who are married filing jointly with $210,000 of AGI in 2015,incurred the following expenses in their efforts to adopt a child:  The adoption was finalized in 2015.What is the amount of the allowable adoption credit in 2015?

The adoption was finalized in 2015.What is the amount of the allowable adoption credit in 2015?

Definitions:

Synaptic Transmission

The process by which neurotransmitters are released by one neuron and received by another, allowing for communication between neurons.

Action Potential

A temporary reversal of the electrical polarity of the membrane of a nerve cell or muscle cell, leading to the transmission of signals along the nerve or muscle fiber.

All-or-none Law

The principle that the strength of a response of a nerve or muscle fiber is not dependent on the strength of the stimulus; if a stimulus is above a certain threshold, a nerve or muscle fiber will fire.

Action Potential

A brief electrical charge that travels down an axon, generating a nerve impulse as a response to a stimulus.

Q14: ChocoHealth Inc.is developing new chocolate products providing

Q38: A proportional tax rate is one where

Q43: In December 2015,Max,a cash basis taxpayer,rents an

Q45: Eric purchased a building in 2005 that

Q48: Tyler has rented a house from Camarah

Q65: Bridget owns 200 shares of common stock

Q88: Larry and Ally are married and file

Q102: All of the following items are deductions

Q123: Steve Greene,age 66,is divorced with no dependents.In

Q144: Cheryl is claimed as a dependent on