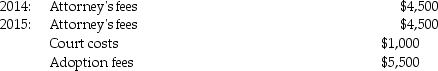

Tyler and Molly,who are married filing jointly with $210,000 of AGI in 2015,incurred the following expenses in their efforts to adopt a child:  The adoption was finalized in 2015.What is the amount of the allowable adoption credit in 2015?

The adoption was finalized in 2015.What is the amount of the allowable adoption credit in 2015?

Definitions:

Refused Orders

Orders that are not accepted or fulfilled by a company due to various reasons, such as inventory shortages or credit issues.

Metrics

Standards of measurement that provide insights or data to track and assess the status or performance of various aspects within an organization.

Effective

Having an intended or expected outcome; producing a decisive result or effect.

Efficient

Achieving maximum productivity with minimum wasted effort or expense.

Q6: Linda was injured in an automobile accident

Q8: Regressive tax rates decrease as the tax

Q31: In computing AMTI,tax preference items are<br>A)excluded.<br>B)added only.<br>C)subtracted

Q42: A taxpayer who uses the LIFO method

Q47: Beth and Jay project the following taxes

Q57: For federal income tax purposes,income is allocated

Q59: Bonjour Corp.is a U.S.-based corporation with operations

Q66: Trent,who is in the business of racing

Q77: Which of the following taxes is proportional?<br>A)gift

Q87: The maximum amount of the American Opportunity