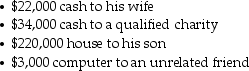

Paul makes the following property transfers in the current year:  The total of Paul's taxable gifts,assuming he does not elect gift splitting with his spouse,subject to the unified transfer tax is

The total of Paul's taxable gifts,assuming he does not elect gift splitting with his spouse,subject to the unified transfer tax is

Definitions:

Simple Analysis of Variance

A statistical method used to compare the means of two or more groups to see if there is a significant difference between them.

One-way ANOVA

A statistical test that compares the means of three or more independent groups to determine if there is a significant difference among them.

Dependent Variable

In an experiment, it is the variable that is being tested and measured, expected to change as a result of modifications to the independent variable.

Television Viewing

The act of watching content on a television set or through television channels.

Q1: All of the following transactions are exempt

Q2: At the beginning of the current year,Terry

Q12: What attributes of a controlled subsidiary corporation

Q25: Moya Corporation adopted a plan of liquidation

Q29: Explain the difference between partnership distributions and

Q35: Arthur uses a Chevrolet Suburban (GVWR 7,500

Q56: If an exchange qualifies as a like-kind

Q63: Discuss the purpose of the imputed interest

Q96: Identify which of the following statements is

Q101: Yael exchanges an office building worth $150,000