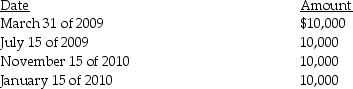

Jack has a basis of $36,000 in his 1,000 shares of Acorn Corporation stock (a capital asset).The stock was acquired three years ago.He receives the following distributions as part of a plan of liquidation of Acorn Corporation:  What are the amount and character of the gain or loss that Jack will recognize during 2009? During 2010?

What are the amount and character of the gain or loss that Jack will recognize during 2009? During 2010?

Definitions:

PR Support

Services or activities provided to help manage and enhance an entity's public image and relationships with its stakeholders.

Employee Relations

Refers to the management and maintenance of the relationship between an employer and its employees, aiming to prevent and resolve workplace issues.

Intranet

A private network used by an organization to securely share company information and computing resources among employees.

Employee Relations

The management of relationships between employers and employees, focusing on communication, engagement, and conflict resolution.

Q2: Junod Corporation's book income is $500,000.What tax

Q4: In accordance with the rules that apply

Q12: Carmen and Marc form Apple Corporation.Carmen transfers

Q33: Identify which of the following statements is

Q35: Paul makes the following property transfers in

Q52: Identify which of the following statements is

Q64: What are the tax consequences to Parent

Q79: In computing the ordinary income of a

Q96: When computing E&P and taxable income,different depreciation

Q116: Azar,who owns 100% of Hat Corporation,transfers land