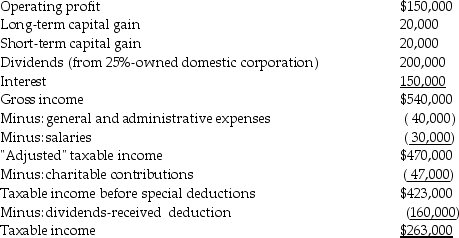

Mullins Corporation is classified as a PHC for the current year,reporting $263,000 of taxable income on its federal income tax return:  Actual charitable contributions made by Mullins Corporation were $75,000.What are the federal income tax due and the personal holding company (PHC)tax liability? Discuss the methods (if any)by which payment of the PHC tax can be avoided.

Actual charitable contributions made by Mullins Corporation were $75,000.What are the federal income tax due and the personal holding company (PHC)tax liability? Discuss the methods (if any)by which payment of the PHC tax can be avoided.

Definitions:

Allowance for Doubtful Accounts

Allowance for doubtful accounts is a financial accounting provision made for receivables that may not be collectible, estimating the portion of outstanding receivables likely to be uncollectable.

Credit Balance

A situation where the amount of credits in an account exceeds the debits, often seen as a positive balance in financial and bank accounts.

Outstanding Receivables

The amount of money owed to a company by its customers for goods or services that have been delivered or used but not yet paid for.

Net Realizable Value

The estimated selling price of goods minus the cost of their sale or completion.

Q10: The WE Partnership reports the following items

Q23: P-S is an affiliated group that files

Q25: Westwind Corporation reports the following results for

Q26: Define intercompany transactions and explain the two

Q40: A consolidated return's tax liability is owed

Q44: Ameriparent Corporation owns a 70% interest in

Q52: Identify which of the following statements is

Q54: Henry transfers property with an adjusted basis

Q78: Identify which of the following statements is

Q86: Identify which of the following statements is