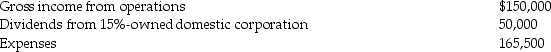

Dumont Corporation reports the following results in the current year:  What is Dumont's taxable income?

What is Dumont's taxable income?

Definitions:

Earnings Per Share

Earnings per share (EPS) is a financial ratio that divides the net earnings available to common shareholders by the average outstanding shares, indicating how much money shareholders would receive for every share owned.

Income Before Interest

Profits calculated after all expenses except interest expenses have been deducted from revenues.

Income Taxes

Income taxes are government levies imposed on individuals and entities' income, varying based on the taxable income amount.

Trend Percent

Trend percent analysis involves comparing financial statements line items over multiple periods to identify patterns or trends in a company's performance over time.

Q6: In 2001,Alejandro buys an annuity for $100,000

Q18: All of Sphere Corporation's single class of

Q22: Explain accountant-client privilege.What are the similarities and

Q27: A consolidated NOL carryover is $52,000 at

Q30: Corporate estimated tax payments are due April

Q35: In 1998,Delores made taxable gifts to her

Q43: A corporation can be subject to both

Q67: Johnson Co.transferred part of its assets to

Q81: Melissa transferred $650,000 in trust in 2006:

Q108: Circle Corporation has 1,000 shares of common