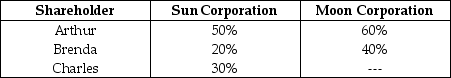

Sun and Moon Corporations each have only one class of stock outstanding.Their stock ownership is shown below.  Which of the four stock ownership changes that are illustrated is the minimum change that is needed if Sun and Moon Corporations are to be brother-sister corporations? (Assume the two corporations are equally valued.)

Which of the four stock ownership changes that are illustrated is the minimum change that is needed if Sun and Moon Corporations are to be brother-sister corporations? (Assume the two corporations are equally valued.)

Definitions:

Financial Statements

Formal records of the financial activities and position of a business, individual, or other entity, including income statement, balance sheet, and cash flow statement.

Cash Basis

An accounting method where revenue and expenses are recognized only when cash is received or paid.

Revenues

The total amount of money received by a company from its business activities, such as sales of products or services, before any deductions.

Revenue Recognition Principle

An accounting principle that determines the specific conditions under which revenue is recognized and recorded.

Q3: Miller Corporation has gross income of $100,000,which

Q12: Outline the computation of current E&P,including two

Q14: Trail Corporation has gross profits on sales

Q23: Identify which of the following statements is

Q28: Administration expenses incurred by an estate<br>A)are deductions

Q30: There are no tax consequences of a

Q49: Stu Walker has owned all 200 shares

Q64: Identify which of the following statements is

Q73: If Brad files his last year's individual

Q90: Panther Trust has net accounting income and