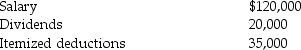

Latka Novatny gave you the following information to use in the preparation of his current year's tax return:  In addition,he received $40,000 from a relative for whom he had worked previously.You have researched whether the $40,000 should be classified as a gift or compensation and are confident that substantial authority exists for classifying it as a gift.What tax compliance issues should you consider in deciding whether to report or exclude the $40,000?

In addition,he received $40,000 from a relative for whom he had worked previously.You have researched whether the $40,000 should be classified as a gift or compensation and are confident that substantial authority exists for classifying it as a gift.What tax compliance issues should you consider in deciding whether to report or exclude the $40,000?

Definitions:

Income

The total amount of money received by an individual or group over a specific time period, coming from various sources like wages, investments, or government assistance.

Apples

Edible fruits produced by an apple tree, characterized by their sweet taste and crisp texture, consumed worldwide.

Bananas

Edible fruits from plants of the genus Musa, commonly enjoyed worldwide and known for their nutritional value.

Utility Function

A representation in economics of how consumers rank different bundles of goods based on the level of satisfaction or utility they provide.

Q31: Money Corporation has the following income and

Q46: Reversionary interests in publicly traded stocks included

Q52: Identify which of the following statements is

Q64: Zerotech Corporation donates the following property to

Q66: Reba,a cash basis accountant,transfers all of the

Q72: Mullins Corporation is classified as a PHC

Q79: What is the penalty for a tax

Q81: Income in respect of a decedent (IRD)includes

Q101: Identify which of the following statements is

Q109: Chris transfers land with a basis of