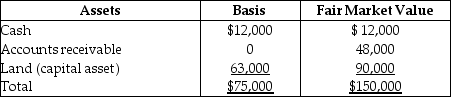

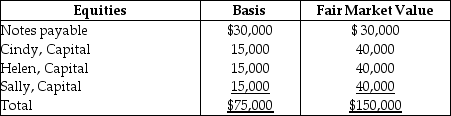

The CHS Partnership's balance sheet presented below is prepared on a cash basis at September 30 of the current year.

Cindy withdraws from the partnership under an agreement whereby she takes one-third of each of the three assets and assumes $10,000 of the notes payable.Her basis for the partnership interest before any distribution is $25,000.What gain/loss should she report for tax purposes?

Cindy withdraws from the partnership under an agreement whereby she takes one-third of each of the three assets and assumes $10,000 of the notes payable.Her basis for the partnership interest before any distribution is $25,000.What gain/loss should she report for tax purposes?

Definitions:

Payment

The transfer of money from one party to another in exchange for goods, services, or to fulfill a legal obligation.

Account

A record or statement of financial expenditure and receipts relating to a particular period or purpose.

Terms

The components of an algebraic expression that are separated by addition or subtraction signs.

Trade Discount

A reduction in the retail price offered by sellers to buyers in the trade as an incentive or reward for buying in bulk or meeting certain conditions.

Q10: Dixon Corporation was incorporated on January 1,2005.The

Q11: Zebra Corporation has always been an S

Q11: If Dane,the CEO of Intech Corp.,adopts a

Q19: A trust reports the following results: <img

Q32: Identify which of the following statements is

Q52: Robert Elk paid $100,000 for all of

Q78: Extinction is the part of the performance

Q89: What is "forum-shopping"?

Q96: Compare and contrast "interpretative" and "statutory" regulations.

Q98: S shareholders cannot increase the basis of