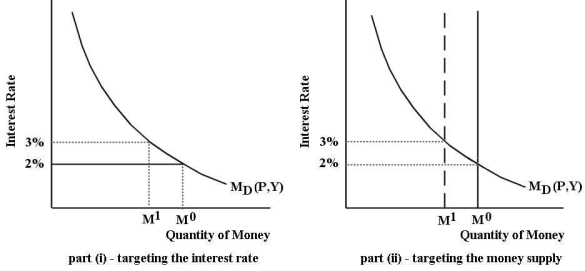

The diagrams below illustrate two alternative approaches to implementing monetary policy.The economy begins in monetary equilibrium with the interest rate equal to 2% and the money supply equal to  .

.  FIGURE 28-1 Refer to Figure 28-1.If the Bank of Canada's goal is to increase the target interest rate from 2% to 3%,then the most effective approach is to

FIGURE 28-1 Refer to Figure 28-1.If the Bank of Canada's goal is to increase the target interest rate from 2% to 3%,then the most effective approach is to

Definitions:

Confidence Level

The probability that a confidence interval captures the true parameter value in repeated samples or experiments.

Population Parameter

A value that represents a characteristic of an entire population, such as its mean or standard deviation, often estimated from a sample.

Confidence Interval

A selection of numerical values, culled from sample data, likely to hold within it the value of an unrevealed population parameter.

Population Mean

The average of all the data points in a population, representing the central tendency of the entire population's values.

Q8: Suppose Canada could produce all goods and

Q32: Suppose two countries each produce wool and

Q39: If there are more job vacancies in

Q42: Bank West's Balance Sheet Assets Liabilities<br>Cash $500

Q43: To remove an inflationary gap,the Bank of

Q63: Consider the following situation in the Canadian

Q79: Consider the sources of the gains from

Q85: Suppose the Bank of Canada raises its

Q100: The diagram below shows the budget deficit

Q119: Consider the following list of entries that