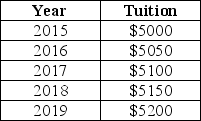

The table below shows hypothetical tuition costs at a Canadian university.  TABLE 2-1 Refer to Table 2-1.Assume that 2015 is used as the base year,with the index number = 100.The value of the index number in 2017 is calculated as follows:

TABLE 2-1 Refer to Table 2-1.Assume that 2015 is used as the base year,with the index number = 100.The value of the index number in 2017 is calculated as follows:

Definitions:

Dividend Value

The portion of a company's earnings distributed to shareholders, typically in the form of cash payments.

Stock Price

The cost of purchasing a share of a particular company, which fluctuates based on market conditions, company performance, and investor sentiment.

Dividend Growth Rate

The annualized percentage rate of growth of a company's dividend payments, indicating the company's dividend payment trend over time.

Expected Dividend

The forecasted payment of dividends to shareholders by a company, typically based on its past dividend payments and financial health.

Q2: Suppose there is a linear relationship between

Q10: In national-income accounting,a rise in G<sub>a</sub> will

Q27: In Shoetown,a rancher takes $0 worth of

Q37: Given a positively sloped supply curve,a rise

Q43: When Ralph Nichols wrote,"We must always withhold

Q47: The following strategies may help overcome some

Q65: Consider a simple macro model with a

Q74: Suppose an economist tells you that the

Q76: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7713/.jpg" alt=" FIGURE 2-2 Refer

Q100: If goods X and Y are complements