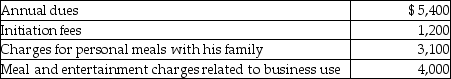

Joe is a self-employed tax attorney who frequently entertains his clients at his country club. Joe's club expenses include the following:  Assuming the business meals and entertainment qualify as deductible entertainment expenses, Joe may deduct

Assuming the business meals and entertainment qualify as deductible entertainment expenses, Joe may deduct

Definitions:

Chest Tube

A medical device used to remove air, fluid, or pus from the intrathoracic space to prevent or treat a collapsed lung or to drain fluid from around the lungs.

Water Seal Chamber

A component of a chest drainage system that prevents air from entering the pleural space while allowing air and fluids to exit, creating a one-way valve mechanism.

Chest X-ray

A diagnostic imaging test that uses a small amount of electromagnetic radiation to produce images of the structures inside the chest, including the heart, lungs, and bones.

Arterial Blood Gas

A test that measures the amounts of oxygen and carbon dioxide in the blood, as well as the acidity (pH) of the blood.

Q3: What would you say are the most

Q4: Margaret, a single taxpayer, operates a small

Q10: Interest expense on debt incurred to purchase

Q11: Guadeloupe,14,notices that friends with different cultural backgrounds

Q19: How do social groups evolve during adolescence

Q20: While Jacintha is at a concert waiting

Q30: An expense is considered necessary if it

Q87: Self-employed individuals may deduct the full self-employment

Q92: A passive activity includes any rental activity

Q115: If a loss is disallowed under Section