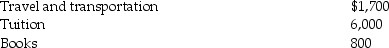

Ellie, a CPA, incurred the following deductible education expenses to maintain or improve her skills:

Ellie's AGI for the year is $60,000.

Ellie's AGI for the year is $60,000.

a. If Ellie is self-employed, what are the amount of and the nature of the deduction for these expenses?

b. If, instead, Ellie is an employee who is not reimbursed by his employer, what are the amount of and the nature of the deduction for these expenses (after limitations)?

Definitions:

Cognitive Psychology

An area of psychology focused on studying mental processes such as perception, memory, thinking, and problem-solving.

Predict

The act of forecasting future events or conditions based on current knowledge or past experiences.

Describe

The act of giving a detailed account or picture of something in words, including all relevant characteristics, qualities, or events.

Explain

To make something clear or easy to understand by describing or giving information about it.

Q37: The area between those things you can

Q40: Adolescents who do not get 8 or

Q43: When Saleem has a problem in school

Q47: A system of norms,beliefs,and values that is

Q61: Which one of the following is a

Q63: Nicole has a weekend home on Pecan

Q74: Explain the rules for determining whether a

Q102: A nondeductible floor of 2% of AGI

Q106: Jill is considering making a donation to

Q121: Jason, who lives in New Jersey, owns