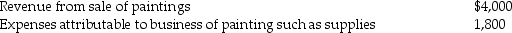

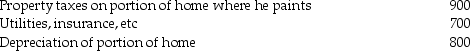

Dighi, an artist, uses a room in his home (250 square feet)as a studio exclusively to paint. The studio meets the requirements for a home office deduction. (Painting is considered his trade or business.)The following information appears in Dighi's records:

Expenses related to home office:

Expenses related to home office:

(a)What is the amount of Dighi's home office deduction if he is self-employed?

(a)What is the amount of Dighi's home office deduction if he is self-employed?

(b)If some amount is not allowed under the tax law, how is the disallowed amount treated?

(c)Assume all of Dighi's records of expenses relating to the room were destroyed in a major paint spill. How much of a home office deduction, if any, will he be allowed?

Definitions:

Validation Theory

A concept in psychology that suggests the acceptance and acknowledgment of an individual's experiences and feelings can lead to their emotional and psychological well-being.

ZMOT

Refers to the "Zero Moment of Truth," a marketing concept indicating the moment when a consumer researches a product online before making a purchase decision.

FMOT

The "First Moment of Truth," which refers to the critical moment when a consumer encounters a product on a store shelf and makes a purchase decision.

Social Commerce

The integration of social media platforms and e-commerce functionalities to drive online sales and interactions with customers.

Q11: Adolescents have increased abilities to think about

Q38: Carlos finds his brother's low spirits depressing,but

Q39: Emma Grace acquires three machines for $80,000,

Q55: A focus on giving the right answer

Q87: During the current year, Lucy, who has

Q88: Wilson Corporation granted an incentive stock option

Q95: Net long-term capital gains receive preferential tax

Q96: Which of the following is deductible as

Q104: Gain on sale of a patent by

Q118: Unless the alternate valuation date is elected,