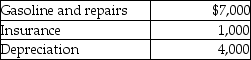

Jordan, an employee, drove his auto 20,000 miles this year, 15,000 to meetings with clients and 5,000 for commuting and personal use. The cost of operating the auto for the year was as follows:  Jordan submitted appropriate reports to his employer, and the employer paid a reimbursement of $ .50 per mile. Jordan has used the actual cost method in the past. Jordan's AGI is $50,000. What is Jordan's deduction for the use of the auto after application of all relevant limitations?

Jordan submitted appropriate reports to his employer, and the employer paid a reimbursement of $ .50 per mile. Jordan has used the actual cost method in the past. Jordan's AGI is $50,000. What is Jordan's deduction for the use of the auto after application of all relevant limitations?

Definitions:

Commitment

The state of being dedicated to a cause or activity, or the act of binding oneself to a course of action.

User Blog

A website or section of a website where an individual or group of users post opinions, information, and updates, often focusing on specific subjects or interests.

Interactive Website

is a web platform that allows users to engage and interact with content and features, enhancing user experience.

Engage

To capture and hold the attention, interest, or involvement of someone, often used in the context of engaging customers or audiences through various mediums.

Q28: The fact that Canadian teens spend so

Q39: A net operating loss (NOL)occurs when taxable

Q41: All of the following are allowed a

Q42: Adolescents who are able to use logical

Q44: Losses from passive activities that cannot be

Q81: Kyle drives a race car in his

Q89: Taxpayers may deduct lobbying expenses incurred to

Q94: A wash sale occurs when a taxpayer

Q110: Martin Corporation granted a nonqualified stock option

Q125: Terra Corp. purchased a new enterprise software