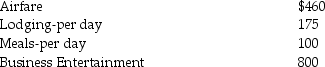

Richard traveled from New Orleans to New York for both business and vacation. He spent 4 days conducting business and some days vacationing. He incurred the following expenses:

What is his miscellaneous itemized deduction (before the floor), assuming Richard is an employee and is not reimbursed, under the following two circumstances?

What is his miscellaneous itemized deduction (before the floor), assuming Richard is an employee and is not reimbursed, under the following two circumstances?

a. He spends three days on vacation, in addition to the business days.

b. He spends six days on vacation, in addition to the business days.

Definitions:

Date of Combination

The specific date when two or more entities come together to form one entity or begin to operate as a combined entity.

Journal Entries

Records of financial transactions in the chronological order they occur, used in bookkeeping.

Q16: On December 1, 2014, Delilah borrows $2,000

Q21: If property received as a gift has

Q28: _ intelligence peaks during the adolescent years,while

Q30: Piaget's theory has been criticized on the

Q31: About half the crimes shown in TV

Q40: As many as one in four adolescents

Q46: Statistics on school safety indicate that<br>A)the number

Q55: During puberty,levels of _ increase much more

Q62: Corporate charitable deductions are limited to 10%

Q87: During the current year, Lucy, who has