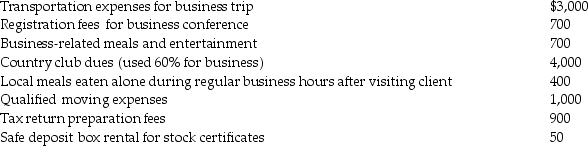

Rita, a single employee with AGI of $100,000 before consideration of the items below, incurred the following expenses during the year, all of which were unreimbursed unless otherwise indicated:

In addition, Rita paid $300 for dues to her professional business association. The company reimbursed her after she submitted the appropriate documentation. What is Rita's net miscellaneous itemized deduction for the year after application of all relevant limitations?

In addition, Rita paid $300 for dues to her professional business association. The company reimbursed her after she submitted the appropriate documentation. What is Rita's net miscellaneous itemized deduction for the year after application of all relevant limitations?

Definitions:

Mutually Exclusive

Describes options or decisions that cannot be adopted or pursued at the same time.

Management Accept

The process of corporate leadership approving strategies, initiatives, or decisions based on their alignment with the organization's objectives and resource capabilities.

Required Rate of Return

The lowest yearly return rate on an investment that appeals enough to persuade people or corporations to invest in a specific venture or financial opportunity.

NPV

Net Present Value (NPV) is the calculation used to determine the current value of a series of future cash flows, discounted at the hurdle rate.

Q12: By 2017,Canada's racialized minorities are predicted to

Q31: The AIDS epidemic has had its most

Q47: According to Havighurst,the developmental task of achieving

Q48: The members of one's reference group who

Q49: During middle adolescence,clique membership<br>A)becomes more diverse in

Q60: Erin's records reflect the following information: 1.

Q79: A theft loss is deducted in the

Q93: Hunter retired last year and will receive

Q95: Discuss why the distinction between deductions for

Q102: A nondeductible floor of 2% of AGI