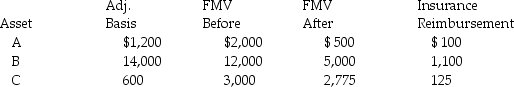

Determine the net deductible casualty loss on the Schedule A for Alan Michael when his adjusted gross income was $40,000 in 2014 and the following occurred:

A and B were destroyed in the same casualty in March. C was destroyed in a separate casualty in July.

A and B were destroyed in the same casualty in March. C was destroyed in a separate casualty in July.

All casualty losses were nonbusiness personal use property losses and none occurred in a federally declared disaster area.

What is the amount of the net deductible casualty loss?

Definitions:

Fallacy

A mistake in logic that makes an argument incorrect or deceptive.

Accident

The fallacy of applying a generalization to a special case in disregard of qualities or circumstances that make it an exception to the generalization.

General

Relating to or involving all or most people, things, or places, especially without specifying details.

Opposite

Pertaining to something that is diametrically different in position, direction, or character from something else.

Q2: Which one of the following fringe benefits

Q5: Which of the following is not required

Q9: DeMarcus and Brianna are married and live

Q12: Tiffany is aware that unprotected sex can

Q36: All of the following may deduct education

Q47: Among adolescents,the remarriage of the custodial parent

Q55: Parents who praise their children's accomplishments and

Q62: A fire totally destroyed office equipment and

Q76: A flood damaged an auto owned by

Q84: List those criteria necessary for an expenditure