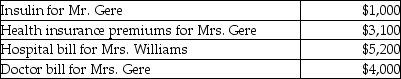

Mr. and Mrs. Gere, who are filing a joint return, have adjusted gross income of $50,000. During the tax year, they paid the following medical expenses for themselves and for Mrs. Gere's mother, Mrs. Williams. The Gere's could claim Mrs. Williams as their dependent, but she has too much gross income.  Mr. and Mrs. Gere received no reimbursement for the above expenditures. What is the amount of their deductible itemized medical expenses?

Mr. and Mrs. Gere received no reimbursement for the above expenditures. What is the amount of their deductible itemized medical expenses?

Definitions:

Human Resources Forecasting

Estimating future HR requirements and availabilities, considering factors such as organizational growth, technological advances, and economic trends, to align workforce planning with strategic goals.

Validity And Reliability

Criteria used to evaluate the accuracy (validity) and consistency (reliability) of a research method or measurement tool.

Quantitative Model

A mathematical model that utilizes quantitative data to forecast or make decisions, often used in finance, operations, and strategic planning.

Mathematical Algorithm

A finite sequence of well-defined instructions typically used to solve a class of specific problems or to perform a computation.

Q15: "No additional cost" benefits are excluded from

Q19: Everybody in Mustafa's family is cheerful and

Q29: International trade,faster communications,and economic interdependence are all

Q33: The suggestion that environmental factors contribute to

Q35: Which one of the following does not

Q37: When girls experience menarche,most respond by<br>A)telling their

Q70: What are some factors which indicate that

Q85: Sam received a scholarship for room and

Q91: In 2006, Gita contributed property with a

Q107: Lewis died during the current year. Lewis