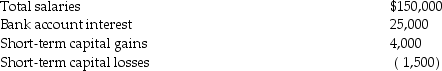

During 2014 Richard and Denisa, who are married and have two dependent children, have the following income and losses:

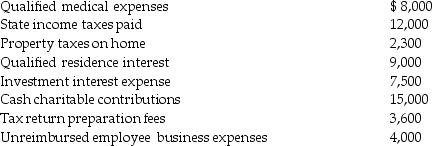

They also incurred the following expenses:

They also incurred the following expenses:

Compute Richard and Denisa's taxable income for the year. (Show all calculations in good form.)

Compute Richard and Denisa's taxable income for the year. (Show all calculations in good form.)

Definitions:

Q10: Which of the following expenses or losses

Q21: Speak Corporation, a calendar year accrual basis

Q22: Wayne and Maria purchase a home on

Q46: Which of the following item(s)must be included

Q66: Chuck, who is self-employed, is scheduled to

Q78: Child support is<br>A)deductible by both the payor

Q90: A taxpayer guarantees another person's obligation and

Q114: Determine the net deductible casualty loss on

Q117: Emeril borrows $340,000 to finance taxable and

Q119: A sole proprietor establishes a Keogh plan.