Phoebe's AGI for the current year is $120,000. Included in this AGI is $100,000 salary and $20,000 of interest income. In earning the investment income, Phoebe paid investment interest expense of $30,000. She also incurred the following expenditures subject to the 2% of AGI limitation:

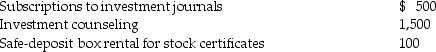

Investment expenses:

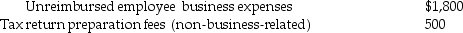

Noninvestment expenses:

Noninvestment expenses:

What is Phoebe's investment interest expense deduction for the year?

What is Phoebe's investment interest expense deduction for the year?

Definitions:

High-Skilled Workers

Employees with advanced education, experience, and skills, often requiring specialized training or knowledge.

Low-Skilled Workers

Employees possessing minimal or no specialized skills, training, or education, often associated with lower-paying jobs.

Labor Union

An organization formed by workers in the same trade or industry to protect their rights and interests.

Customer Discrimination

A situation where consumers' preferences or prejudices influence their decisions on whom to do business with, impacting market outcomes.

Q6: Ms. Marple's books and records for 2014

Q8: Any distribution from a Qualified Tuition Plan

Q9: Charles is a single person, age 35,

Q13: In Howard Gardner's view,highly skilled dancers,athletes,and surgeons

Q14: Mr. and Mrs. Gere, who are filing

Q38: Mattie has group term life insurance coverage

Q47: Internal Revenue Code Section 61 provides an

Q52: Capital expenditures for medical care which permanently

Q97: The fair value of lodging cannot be

Q102: Brad suffers from congestive heart failure and