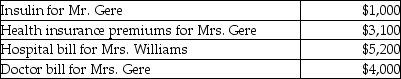

Mr. and Mrs. Gere, who are filing a joint return, have adjusted gross income of $50,000. During the tax year, they paid the following medical expenses for themselves and for Mrs. Gere's mother, Mrs. Williams. The Gere's could claim Mrs. Williams as their dependent, but she has too much gross income.  Mr. and Mrs. Gere received no reimbursement for the above expenditures. What is the amount of their deductible itemized medical expenses?

Mr. and Mrs. Gere received no reimbursement for the above expenditures. What is the amount of their deductible itemized medical expenses?

Definitions:

Q8: Losses incurred in the sale or exchange

Q9: Examples of income which are constructively received

Q24: Girls who see themselves as overweight,even when

Q25: Lindsey Forbes, a detective who is single,

Q29: On July 1 of the current year,

Q35: All of the following are requirements for

Q45: Chad and Jaqueline are married and have

Q81: On September 1, of the current year,

Q108: A taxpayer sells an asset with a

Q115: If a loss is disallowed under Section