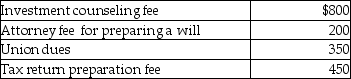

Daniel had adjusted gross income of $60,000, which consisted of $55,000 in wages and $5,000 in dividend income from taxable domestic corporations. His expenses include:  What is the net amount deductible by Daniel for the above items?

What is the net amount deductible by Daniel for the above items?

Definitions:

Phobias

Excessive and irrational fears of specific objects, situations, or activities that pose little to no actual danger.

Fear of Danger

A basic emotional state characterized by the anticipation or awareness of potential harm or threats.

Contamination

The presence of an unwanted substance or microorganism in another substance, place, or physical body, leading to potential harm.

Prevalence Rate

The proportion of a population found to have a particular condition at a specific time.

Q7: Adolescents and young adults are particularly in

Q41: The wherewithal-to-pay concept provides that a tax

Q47: During the current year, Deborah Baronne, a

Q50: Laura, the controlling shareholder and an employee

Q55: Adam owns interests in partnerships A and

Q65: Marcia, who is single, finished graduate school

Q104: Gain on sale of a patent by

Q106: Kendal reports the following income and loss:<br>

Q123: Rita died on January 1, 2014 owning

Q129: Steven is a representative for a textbook