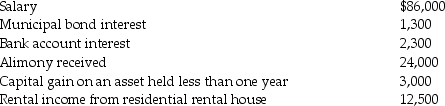

During the current year, Donna, a single taxpayer, reports the following items income of income and expenses:

Income:

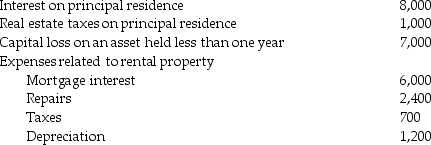

Expenses/losses:

Expenses/losses:

Compute Donna's taxable income. (Show all calculations in good form.)

Compute Donna's taxable income. (Show all calculations in good form.)

Definitions:

Organizational Processes

The methods and routines through which a company operates and ensures that its goals and objectives are efficiently achieved.

Reengineering

A radical redesign of business processes to achieve dramatic improvements in critical aspects like cost, quality, service, and speed.

OD Technique

Organizational Development Technique refers to specific methods used to improve interpersonal, group, or organizational effectiveness.

Team Building

Activities or exercises designed to enhance teamwork, communication, and cooperation among members of a group or organization, aiming to improve collective performance.

Q2: Unemployment compensation is exempt from federal income

Q8: Natasha is a single taxpayer with a

Q17: While points paid to purchase a residence

Q25: Many exclusions exist due to the benevolence

Q39: Pat, an insurance executive, contributed $1,000,000 to

Q48: Kate subdivides land held as an investment

Q73: Hope sustained a $3,600 casualty loss due

Q114: In 2006, Regina purchased a home in

Q125: Terra Corp. purchased a new enterprise software

Q135: An individual may not qualify for the