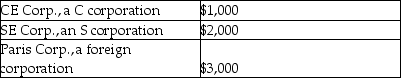

Natasha is a single taxpayer with a 28% marginal tax rate. She received distributions of earnings this year as follows:  How much of the $6,000 distribution will be taxed at the 15% tax rate?

How much of the $6,000 distribution will be taxed at the 15% tax rate?

Definitions:

Sleep Apnea

A sleeping disorder marked by interruptions in breathing or instances of shallow or infrequent breathing during sleep.

Postmenopausal Women

Women who have gone through menopause, marking the end of their reproductive years.

Genetic Predisposition

The heightened probability of contracting a specific disease due to an individual's genetic composition.

Slow-Wave Sleep

A phase of deep sleep characterized by delta wave activity, essential for physical rest and recovery.

Q4: Margaret, a single taxpayer, operates a small

Q25: Improvements to leased property made by a

Q51: If an activity produces a profit for

Q52: Britney is beneficiary of a $150,000 insurance

Q66: Itemized deductions are deductions for AGI.

Q66: An LLC that elects to be taxed

Q79: The Pension Model has all of the

Q81: On September 1, of the current year,

Q84: Thomas purchased an annuity for $20,000 that

Q113: Julia, age 57, purchases an annuity for