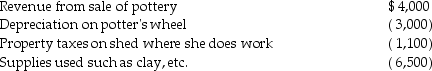

Margaret, a single taxpayer, operates a small pottery activity in her spare time. During the current year, she reported the following income and expenses from this activity which is classified as a hobby:

In addition, she had salary of $75,000 and itemized deductions, not including those listed above, of $2,200.

In addition, she had salary of $75,000 and itemized deductions, not including those listed above, of $2,200.

What is the amount of her taxable income?

Definitions:

Consumer Surplus

The variation between the sum consumers are willing to allocate for a good or service and the sum they actually allocate.

Surplus II

An additional amount of a resource, product, or service that exceeds the amount demanded or utilized.

Consumer Surplus

The discrepancy between what consumers are willing to spend on a good or service and their actual expenditures.

Surplus II

An excess of supply over demand in the market, leading to excess goods and potential lower prices.

Q12: Candice owns a mutual fund that reinvests

Q16: Ruby Corporation grants stock options to Iris

Q48: What is required for an individual to

Q67: On Form 1040, deductions for adjusted gross

Q81: Richard traveled from New Orleans to New

Q88: After he was denied a promotion, Daniel

Q99: Galvin Corporation has owned all of the

Q109: The definition of medical care includes preventative

Q112: Ryan and Edith file a joint return

Q113: Why was Section 1244 enacted by Congress?