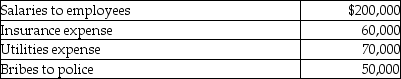

Troy incurs the following expenses in his business, an illegal gambling establishment:  His deductible expenses are

His deductible expenses are

Definitions:

Noncompliance

The act of failing or refusing to comply with rules, laws, or instructions.

Chronic Illness

A long-term health condition that requires ongoing management over a period of years or decades.

Physical Dependence

A physiological state in which the body adapts to the presence of a substance, leading to withdrawal symptoms if it is reduced or stopped.

Withdrawal Illness

A condition characterized by a set of symptoms that occur upon the abrupt discontinuation or decrease in intake of medications, recreational drugs, or substances.

Q1: Business investigation expenses incurred by a taxpayer

Q22: Troy incurs the following expenses in his

Q22: Norah, who gives music lessons, is a

Q32: Lisa loans her friend, Grace, $10,000 to

Q42: Dividends on life insurance policies are generally

Q55: Adam owns interests in partnerships A and

Q66: An accrual-basis corporation can only deduct contributions

Q89: If a taxpayer's method of accounting does

Q95: Exter Company is experiencing financial difficulties. It

Q114: On August 1 of this year, Sharon,