Essay

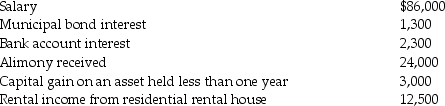

During the current year, Donna, a single taxpayer, reports the following items income of income and expenses:

Income:

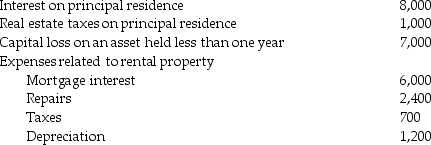

Expenses/losses:

Expenses/losses:

Compute Donna's taxable income. (Show all calculations in good form.)

Compute Donna's taxable income. (Show all calculations in good form.)

Definitions:

Related Questions

Q8: Finance charges on personal credit cards are

Q22: Norah, who gives music lessons, is a

Q37: Julia provides more than 50 percent of

Q39: Major change(s)in the lives of Canadian adolescents

Q56: Daniel had adjusted gross income of $60,000,

Q80: Mara owns an activity with suspended passive

Q87: Self-employed individuals may deduct the full self-employment

Q104: While using a metal detector at the

Q120: According to the tax formula, individuals can

Q122: Jessica owned 200 shares of OK Corporation