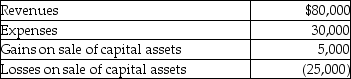

Topaz Corporation had the following income and expenses during the current year:  What is Topaz's taxable income?

What is Topaz's taxable income?

Definitions:

Revenue Recognition

the accounting principle dictating the conditions under which revenue is considered earned and can be recorded in the financial statements.

Contract Price

The agreed-upon price for goods or services that is specified in a contractual agreement.

Critical Event

A significant occurrence that has a substantial impact on the operations or financial health of a business or market.

Measurability Conditions

Criteria required to recognize a financial transaction, including the ability to reliably measure the transaction's impact on the financial statements.

Q13: Discuss briefly the options available for avoiding

Q27: Fees paid to prepare a taxpayer's Schedule

Q31: Brianna purchases stock for $8,000. The stock

Q37: Julia provides more than 50 percent of

Q47: Deductions for AGI may be located<br>A)on the

Q52: All of the following items are generally

Q66: An accrual-basis corporation can only deduct contributions

Q73: The Roth IRA is an example of

Q120: During 2013, Mark's employer withheld $2,000 from

Q127: If the stock received as a nontaxable